The Shock

On 4th December 2021, as the world is battling COVID-19 newest variant; Omicron, the USA began an astonishing public information campaign to alert the world to the possibility of a full Russian invasion of Ukraine by early 2022. What started as a classic skepticism by most governments and the global audience, turned into outright shock and disillusion as the Russian president announced on the evening of 24th February 2022 a “Special Military Operation” in Ukraine. It was a declaration of war and war it is.

That a major Eurasian world power has declared war on a major Eastern European country was the biggest geopolitical shock experienced globally since September 11. What followed was a series of escalator steps by the West and Russia that reached its peak in the Russian announcement of moving its nuclear forces on high alert. Everything was moving fast, too fast to digest for the mundane. It was horrifying. It still is.

The unprecedented sanctions imposed on the Russian economy are the most severely imposed on any nation in modern times; seemingly aiming at applying maximum pressure on the Russian leadership as a negotiating card to end the conflict and as a warning shot to those pondering similar adventures.

What the World Can Expect

It is impossible to overestimate the massive consequences of the conflict and the associated economic sanctions on the global economy; of which the Real Estate sector is an integral part. Let me try to unpack some of the short- and medium-term consequences here.

Although the Russian economy, with its US$1.4 T GDP, is small relative to other major world economies (the USA’s GDP is US$20 T and China’s GDP is US$14 T), a deeper dive into the constituencies of such an economy indicates more strength and leverage than meets the eye.

For example, Russia is the world’s 3rd largest producer of oil and the world’s 2nd leading producer of all fossil fuels including natural gas. It provides 45% of Europe’s natural gas needs alone. On the evening of the Russian war declaration, oil prices jumped from US$80 to more than US$100 per barrel. When news came out about a possible nuclear power plant in Ukraine on fire and a heightened radiation level, oil jumped to US$120 per barrel. Talk about an incoming global recession!

Despite the popular impression, I cannot imagine an oil-producing nation such as the UAE, being too thrilled with such a high oil price. Although immediate revenues are going to be higher, costs will also skyrocket as oil and COVID-19 derived supply chain hurdles are wreaking havoc on the global economy and causing a huge inflation.

There comes a point in any rising commodity prices, oil included, when what economists call “demand destruction” takes place, which acts as a natural balance to the shortened supply, bringing both to equilibrium and prices to a reasonable market value. Whether or not this happens at the same time as other inflated commodities and assets will play the main role in whether and to what extent the UAE economy is negatively affected.

But that is not the whole story…

See, Russia and Ukraine combined are responsible for 25% of global wheat exports. Ukraine exports 13% of global corn production. We are now talking about bread and basic food security needs for the rest of the world; the price of which is already flying high, while supply is shrinking at an increasing pace.

Additionally, Russia is one of the world’s largest exporters of raw materials, particularly metals. Its market share of total global exports in nickel is estimated at around 49% – palladium: 42%, diamonds: 33%, aluminum: 26%, platinum: 13%, steel: 7% and copper: 4%. It has the world’s fourth-largest reserves of the group of 17 rare earth metals with unique electronic and magnetic properties that are vital to most modern electronic products.

From energy to food security to electronics, the value added by Russian commodities to the world’s economy can neither easily nor quickly be replaced.

What About the UAE Economy?

It is not all negative. As an oil-producing country, the UAE is in a strong position to absorb the increasing cost of commodities, food, and raw material imports that can be offset by the higher prices of oil exports. The geopolitically neutral approach of the UAE leadership, combined with the excellent way the COVID-19 crisis has been handled are leading to the emergence of the UAE as one of the most attractive spots in the world for foreign investors.

We all saw the great success of Expo 2020 in Dubai with millions of visitors flocking to the country despite the COVID scare and the associated travel restrictions. Personally, I was skeptical but fortunately, I was wrong.

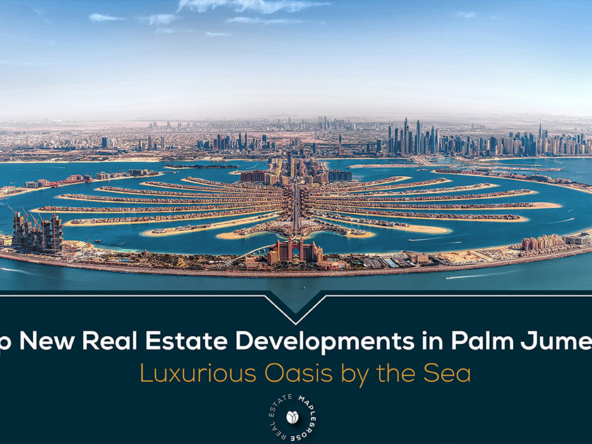

UAE Real Estate Market Overview: Let’s Talk Real Estate

But enough of all that. Back to real estate and its close relative; tourism.

In 2016, Russian investors ranked 7th on the top ten list of real estate investors in Dubai by nationality, superseding the Americans and the French. Although this is no longer the case, Russians remain one of the top 15 investors in real estate in the UAE. Perhaps one can theorize that wealthy Russians have increasingly diverted their real estate investments to European capitals before the conflict. Well, not anymore.

One can imagine, quite plausibly, that the severe sanctions, which froze a major nation’s central bank reserves (or half of it), and sanctioned super wealthy Russian oligarchs across the West, have dealt a huge blow to the confidence of foreign wealthy investors in those Western capitals. The message is clear. If you are a wealthy non-Westerner (or belong to a nation whose leadership isn’t aligned with the West), your money isn’t safe.

I dare to think the coming weeks and months will witness a significant outflow of foreign direct investment, especially in the real estate sector from major Western Capitals to the East. I can see this happening certainly by Russians and highly probable by others.

With its independence, neutrality, safety, security, sun, beaches, and luxury, UAE is well-positioned to benefit from that trend.

However, there are challenges. Plenty of them actually.

Those include the expected drop in the number of Russian and Ukrainian tourists and of course the inability of Russia-based investors to use the SWIFT system to transfer money and consequently invest in the UAE.

So, what now?

Part of me is excited to witness history in the making, yet a glimpse of the suffering and damage caused by war is enough for such feelings to vanish. However, war has always been history’s strongest hand for change and those who capitalize on opportunities during times of change, emerge stronger.

I hope I have managed to slightly unpack some of the complicated layers of this conflict and its short-term consequences on the global economy and the real estate industry in the UAE, without causing too much confusion or causing my head to explode.

I emphasize the expression “short term” as the long-term consequences are mere forecasts that require much longer writing to unpack and potentially a brain much more intelligent than mine.

These are tricky times and only wise and calm navigation will lead to a nation not only surviving but thriving. I have no doubt the UAE is one such nation. I leave you all in peace.

Till next time…

For the latest insights on UAE real estate and trending UAE real estate news, check out our Maple & Rose Blog every week and access the latest articles, reports and in-depth analysis from the experts at Maple & Rose.

For more UAE real estate information, UAE real estate forecast and property for sale in UAE, check out our website at https://maplenrose.com.